Corporate Governance

Basic Philosophy

The Valuence Group including the Company has established “Circular Design for the Earth and Us” as our purposeand “To Encourage More People to Focus on What is Most Important in Their Lives” as our mission. We are working to maintain and improve management transparency, fairness, and speed by implementing and strengthening corporate governance. Through dialogue with all stakeholders, we are working to achieve sustainable growth and increase corporate and shareholder value over the medium to long term.Corporate Governance Report

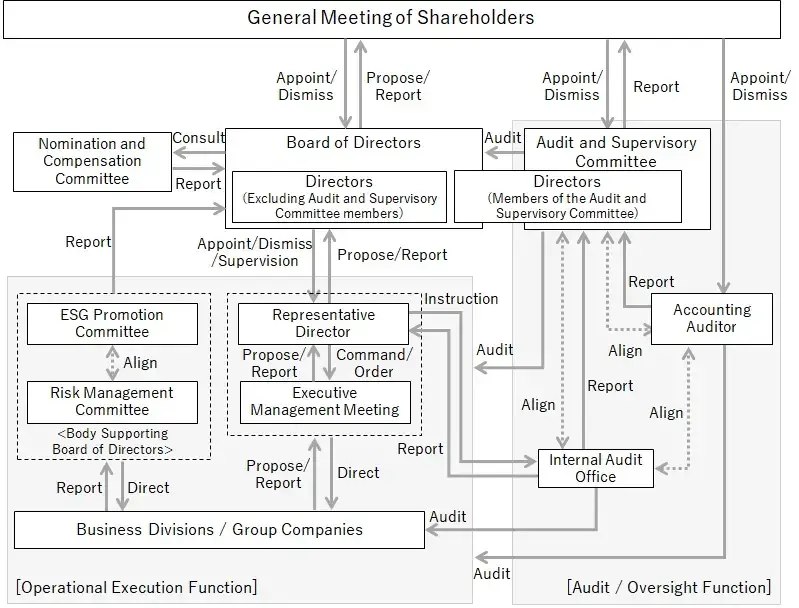

Corporate Governance Structure

The company has adopted the structure of a company with an Audit and Supervisory Committee. By establishing a General Meeting of Shareholders, a Board of Directors, an Audit and Supervisory Committee, a financial statement auditor, and an Executive Management Committee whose function is the daily execution of business operations, the company ensures sound, efficient management via coordination among these institutions. In particular, in order to increase the effectiveness of management oversight by the Board of Directors, we are striving to increase the ratio of outside directors to at least one-third of the Board of Directors to the maximum possible majority, and we are working to further strengthen corporate governance. In addition, the Nomination and Compensation Committee, the Risk Management Committee and the ESG Promotion Committee have been established as voluntary bodies of the Board of Directors to enhance corporate governance.

Corporate governance structure diagram

Corporate Institutions

Board of Directors

The Company’s board of directors is composed of 10 members: 6 directors who are not members of the Audit and Supervisory Committee, of which 2 are outside directors, and 4 directors who are members of the Audit and Supervisory Committee, of which 3 are outside directors. Of the total, 4 directors are independent outside directors.

The board meets regularly once per month, as well as in special board meetings convened as necessary. The board supervises business

operations and makes important management decisions, including company policies and business strategy. Directors who are Audit and Supervisory Committee members attend all board of director meetings to audit the state of business execution by the directors.

Audit and Supervisory Committee

The Company’s Audit and Supervisory Committee consists of 4 members, of which 3 are outside directors. In principle, this committee meets once each month. In addition, the committee exchanges information and opinions with the financial statement auditors and Internal Audit Office as necessary, working to substantially improve audits.

Directors ProfileExecutive Management Meeting

In order to speed up and improve the efficiency of business execution, the Company holds, in principle, 2 meetings of the Executive Management Meeting each month. This meeting is comprised of directors (excluding non-executive directors) and executive officers to formulate business strategies, check progress, and share issues between departments. The executive management meeting functions effectively as an entity for directing and communicating important business matters, as well as in promoting a unified awareness organization-wide. The director who is a full-time member of the Audit and Supervisory Committee attends all meetings of the Executive Management Meeting, striving to grasp the situations within the Company as well as risks.

Nomination and Compensation Committee

The Company has established the Nomination and Compensation Committee as an optional advisory body to the board of directors. The Nomination and Compensation Committee consists of the representative director, and 2 outside directors to improve fairness, transparency, and objectiveness of the procedures relating to the nomination and compensation, etc. of directors and strive to enhance corporate governance.

Risk Management Committee

The Company has established the Risk Management Committee, chaired by the representative director. The Risk Management Committee meets once per month in principle and collects and analyzes organization-wide compliance and risk information and manages risks exhaustively and comprehensively.

ESG Promotion Committee

The Company has established the ESG Promotion Committee chaired by the director in charge of ESG promotion. ESG Promotion Committee meets once per month in principle and discusses major policies and measures related to the promotion of ESG and reports on the planning and progress to the Board of Directors.

Status of Internal Control Systems

The company has established an Internal Controls System Basic Policy. This policy defines a system of internal controls established by the board of directors. The Company has also found other internal rules to ensure transparent and fair business practices. The company rigorously enforces these policies and rules. As a structure for verifying that the internal controls system functions properly and generates the intended results, in addition to reviews by the boards of directors, the internal controls system is reviewed periodically to ensure that systems are developed and enhanced to ensure internal cohesiveness and control groupwide and to respond adequately to external risks.

Status of Risk Management Structure

To manage risk, the company has established a permanent Risk Management Committee chaired by the representative director responsible for administration at company headquarters. This committee is intended to safeguard against risks posing significant potential to impact company business and to act promptly and judiciously to minimize damage in the event of an actual crisis or emergency, thereby contributing to the effective management of business operations. The Risk Management

Committee is also intended to implement comprehensive risk identification and assessment of all risks, potential or actual.

The Risk Management Committee is composed of officers and employees designated by its chairperson. It gathers and analyzes risk information for the group as well as serves as a forum for comprehensive risk management. Each department head is responsible for day-to-day risk management in the department’s operations. In the event of an emergency, this individual is responsible for taking initial action to limit damage and for reporting immediately to the Legal Division (home to

the Risk Management Committee) with detailed information on the nature of the emergency and actions taken. As a corporate entity, the company understands the imperative nature of legal and regulatory compliance. The company has established rules governing compliance and has taken steps to ensure familiarity with these rules by all officers and employees. The rules require officers and employees to comply with laws, public order, social norms, industry self-regulation, ethics, and

morals. The company also requires the company, officers, and employees to act in accordance with those rules as demanded by customers, business partners, shareholders, general citizens, nations, and other interested parties with whom the company has relationships.

The company is a business operator handling personal information as defined under the Act on the Protection of Personal Information and a certified Privacy Mark Entity. The company understands that the leakage or

other disclosure of personal information collected and retained by the company has a direct impact on the confidence society places in its organization. Accordingly, the company has designated a personal information protection manager and a Specific Personal Information manager within the company. The company has also established a personal information management system in compliance with JIS Q 15001:2023. This system is managed and operated by the PMS Office.

Internal Reporting System

The Company has established an Internal Reporting System as a reporting system for when officers, employees, or others discover acts in violations of compliance. In addition to an internal contact point, a system has been established so that reporting can also be made to a third-party agent (consultant lawyer).

External Reporting Systeme

An External Reporting System has also been established as a reporting system for when an external party discovers a breach of compliance by officers, emplovees, or others. A system is in place to receive reports from external parties.