Disclosures in Accordance with TCFD Recommendations

Introduction

The Valuence Group recognizes that climate change is one of the most important management issues related to our business activities. To resolve the issue, we intend to strengthen our governance structure, analyze the impact of climate change risks on our business, take appropriate measures to deal with climate change risks, pursue opportunities for growth, and incorporate related measures into corporate strategy. Accordingly, we endorse the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) established by the Financial Stability Board (FSB). We address climate change in a proactive manner, and we disclose relevant information toward our goals of realizing environmental and social sustainability, as well as sustainable growth for our company.

Governance

The Valuence Group recognizes that responding to sustainability is one of the important management issues, and the Board of Directors deliberates and makes decisions on important matters related to sustainability. By appointing an outside director who is well-versed in sustainability, the Board of Directors has the appropriate knowledge, experience and capabilities to oversee sustainability.

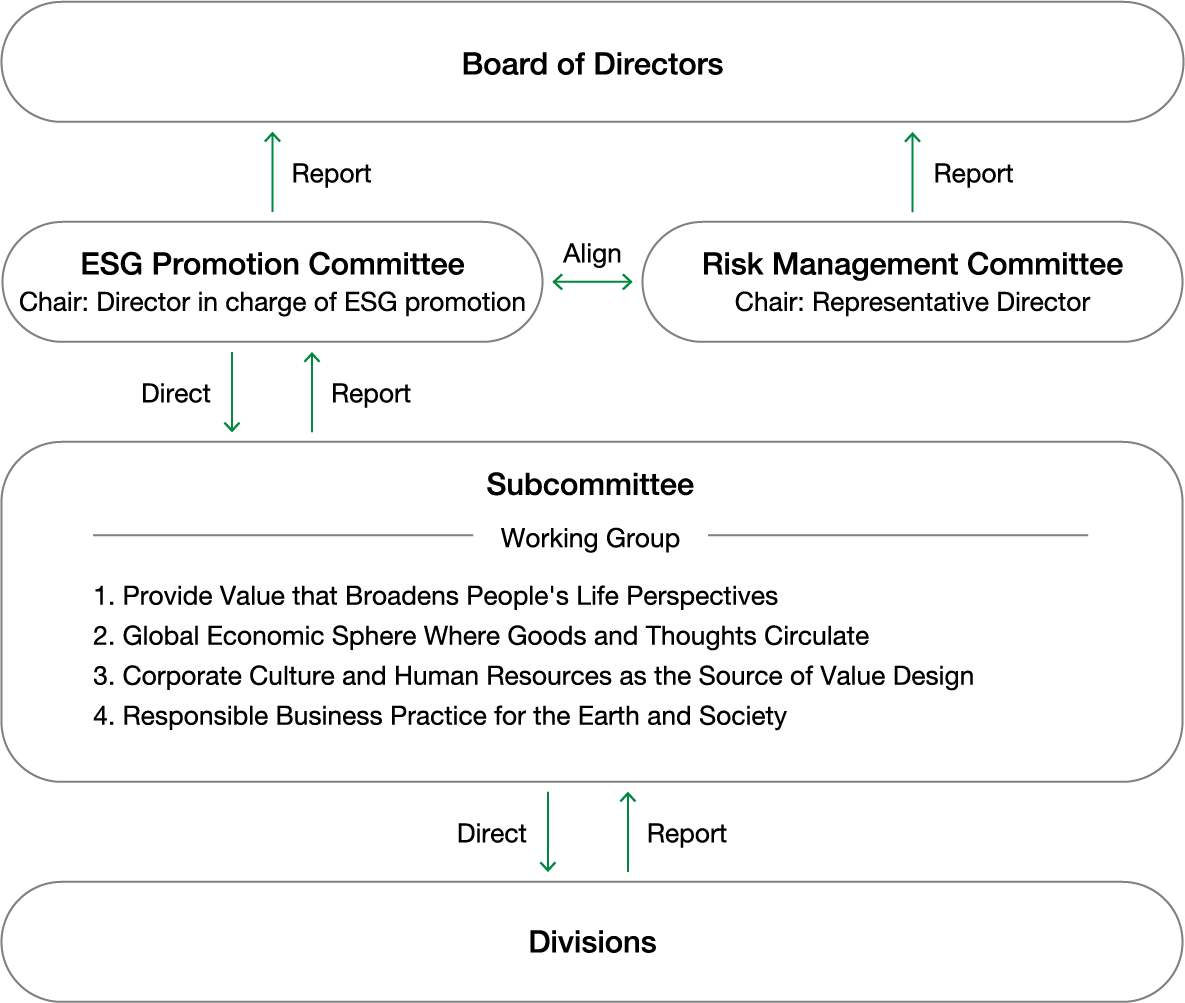

The ESG Promotion Committee is responsible for the execution of sustainability-related operations as an advisory body to the Board of Directors and evaluates sustainability-related risks and opportunities, identifies materiality (important issues), sets indicators and targets for resolving issues, and manages progress. In order to clarify the person in charge of sustainability strategies and further promote sustainability management within the Valuence Group, subcommittees have been established for each key theme as subordinate organizations of the ESG Promotion Committee, and ESG Promotion Committee members have been appointed as the person in charge of each subcommittee.

The Board of Directors receives reports on the content discussed and resolved by the ESG Promotion Committee and Risk Management Committee, and based on the content of these reports, it discusses and deliberates on the Group's policies and action plans for addressing sustainability issues, as well as overseeing their execution. The director in charge of ESG promotion serves as the chair of the ESG Promotion Committee and is responsible for the execution of sustainability initiatives. In addition, the representative director serves as the chair of the Risk Management Committee and is ultimately responsible for the execution of risk management, including sustainability risks.

Strategy

Risks and Opportunities Over the Short-, Medium-, and Long-Term

We believe in the necessity of establishing and examining milestones for climate change-related risks and opportunities, as these risks have the potential to impact the Valuence Group over the long term. We examined climate-related risks and opportunities for the years 2025, 2030, and 2050, which we consider short-, medium-, and long-term time frames.

Process for Determining the Impact of Risks and Opportunities on Business, Strategic, and Financial Plans

We conducted scenario analyses to understand the risks, opportunities, and impacts of climate change on the Valuence Group. These analyses also assessed the resilience of Valuence Group strategies and the need for further measures. We included the value chain of our mainstay businesses in the analyses, addressing the purchase and sale of luxury brand goods, antiques, and fine art. Risks were identified from the perspective of transition risk (regulatory, technology, market, and reputation) and physical risk (acute and chronic). We then scored the degree of impact of the risks with consideration for financial perspectives, employee safety, and social reputation. We assessed transition risk referencing the Net Zero Emissions by 2050 Scenario (NZE) of the IEA (2021). We assessed physical risk referencing the Representative Concentration Pathways (RCP8.5) of the IPCC (2014).

Scenario Analysis Results and Strategic Resilience

The Valuence Group recognizes the importance of ongoing strategic resilience improvements to achieve carbon neutrality. To this end, we consider specific measures to transfer, avoid, or mitigate risks, while also responding to opportunities. We incorporate matters we deem particularly important into our group strategy, managing these matters accordingly.

The table below details risks and opportunities, responses, and resilience strategies.

Reference Scenarios

| Projected World Situation | Adopted Scenarios |

|---|---|

| Transition Risk Below 1.5°C Scenario | Net-Zero Emissions by 2050 Scenario (NZE) IEA (2021) |

| Physical Risk 4°C Scenario | Representative Concentration Pathways (RCP8.5) IPCC (2014) |

Summary of Valuence Group Climate-Related Risks and Opportunities

| Climate-Related Risks and Opportunities | Summary | Timing | Degree of Impact | Response | ||

|---|---|---|---|---|---|---|

| Risks | Transition Risk |

Regulatory/ Legal |

|

Medium Term (2030) |

Medium |

|

| Technology |

|

Short Term (2025) |

Low |

|

||

| Market |

|

Short Term (2025) |

Low |

|

||

|

Medium Term (2030) |

Medium |

|

|||

| Reputation |

|

Short Term (2025) |

High |

|

||

| Physical Risks | Acute |

|

Medium Term (2030) |

High |

|

|

| Chronic |

|

Long Term (2050) |

High |

|

||

| Opportunities | Resource Efficiencies |

|

Short Term (2025) |

Medium |

|

|

| Energy Sources |

|

Medium Term (2030) |

Low |

|

||

| Products and Services |

|

Short Term (2025) |

High |

|

||

| Market |

|

Medium Term (2030) |

Medium |

|

||

| Resilience |

|

Short Term (2025) |

- | - | ||

As a result of the scenario analyses described above, the Valuence Group once reconfirmed the following key transition risks: the loss of business opportunities due to inadequate responses to climate change; reputation damage; the ability to attract talent; and employee engagement. In terms of physical risks, we recognized the impact of natural disasters on physical stores, offices, and warehouses as a major risk. At the same time, we reaffirmed that the emergence of circular economies presents an opportunity to expand the reuse market, which aligns with our mainstay businesses. To this end, we strive to achieve carbon neutrality, driven by the belief that our response to the risks identified will lead to business opportunities and enhanced corporate value. In particular, we are working with a sense of urgency to address risks having the highest degree of impact. Specifically, we participate in and endorse various initiatives, expand disclosure on our efforts to address climate change, and work to reinforce systems in preparation for disasters. In addition to reducing Scope 1 and 2 emissions, we are also considering measures to reduce Scope 3 CO2 emissions. We will prioritize categories having high emissions, aiming ultimately to achieve carbon neutrality.

Risk Management

The Valuence Group selects activities, focusing on our mainstay businesses, to be addressed by the ESG Promotion Committee. The ESG Promotion Committee examines risks and opportunities related to climate change in detail. The ESG Promotion Committee reports its discussions and deliberations to the Board of Directors. Risks and opportunities found to be particularly important are reflected in Group management strategies and managed by the ESG Promotion Committee. In addition, the results of climate change risk analysis and the progress of initiatives to address climate change are shared with the Risk Management Committee, the body responsible for group-wide risk management, and the status of risk management on climate change is monitored by the Risk Management Committee. The ESG Promotion Committee and the Risk Management Committee work in cooperation to manage climate change-related risks.

Metrics and Targets

The Valuence Group uses greenhouse gas emissions as an indicator of our efforts to address climate change. Our goal is to become carbon neutral throughout the value chain by FY2030. Going forward, we will work to grasp our present situation, including the calculation of greenhouse gas emissions, and discuss specific measures to reduce environmental impact, as well as to further enhance our disclosures on climate change.

Updated Dec. 16, 2024